Commuter Tax Benefits

What Are Commuter Tax Benefits?

Commuter Benefits, or Transportation Fringe Benefits, refers to the tax treatment that is provided to employers and employees in relation to certain commuting costs. Under Federal law (26 U.S. Code § 132), an employer may provide (or withhold) up to $340/month in 2026 for qualified transit and vanpool expenses. Commuters may also double the value of the benefit when parking at transit facilities.

Employers Save

The transit portion of the commuter benefit makes sense for businesses of all shapes and sizes. The provision is a pre-tax benefit not only for employees, but also for the employers who offer it. Employers can reduce payroll taxes, providing a sound fiscal saving for the employer. This does not count savings from reduced parking needs and increased productivity.

Employees Save

The primary advantage to employees is that the transit benefit provides tax incentives to those who take transit or a vanpool. These savings are in addition to the hundreds of dollars a year saved from auto-related expenses like fuel, maintenance, and insurance.

IRS Information

The Internal Revenue Service (IRS)'s Publication 15-b offers information on the tax treatment of fringe benefits provided by employers to their employees. It describes the many kinds of fringe benefits and makes it clear which ones are and are not taxed to the employee, including information on the Qualified Transportation Fringe Benefit.

Current Legislation & Advocacy Initiatives

HR 409 - Supporting Transit Commutes Act

Sponsor: Jake Auchincloss, (D-MA-4), Mike Lawler (R-NY-17)

Why Important to ACT: Transit subsidies are a transformative commuter benefit that improves access to jobs and removes barriers to sustainable transportation. When employers offer them, it’s a win for workers and a win for our communities' mobility. Our workforce, businesses, and environment all stand to gain if tax deductibility is restored.

Status: Introduced in House - ACT Endorsed

HR 3936/S. 2023 - Bicycle Commuter Act of 2025

Sponsor: Senator Peter Welch, (D-VT), Senator Alex Padilla (D-CA), Congressman Mike Thompson (D-CA-4)

Why Important to ACT: This bill reestablishes pre-tax commuter benefits for individuals who bike to work, while also allowing those benefits to be used in conjunction with other commuter tax benefits including parking, transit, and vanpooling. Importantly, the legislation expands eligibility to include electric bicycles and bike or scooter share programs, recognizing the evolving landscape of micromobility options.

Status: Introduced in House & Senate - ACT Endorsed

Policy Victories

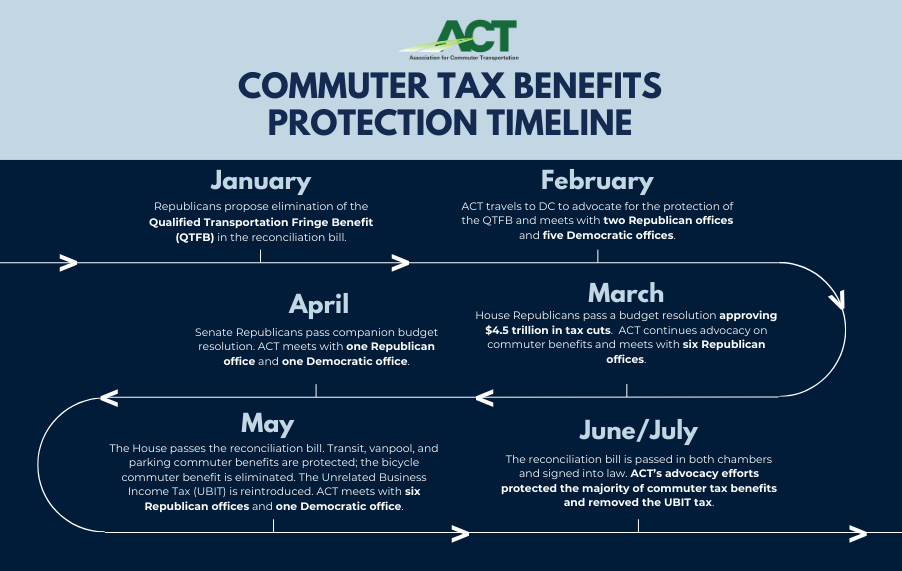

Commuter Tax Benefit Protection in the One Big Beautiful Bill Act

At the start of the 119th Congress, a proposal to eliminate the Qualified Transportation Fringe Benefit (QTFB) in its entirety - including transit, vanpool, parking, and bicycle benefits - was floated as part of Republican cost-cutting efforts for the budget reconciliation process. Through sustained and strategic advocacy, ACT was able to protect transit, vanpool, and parking benefits, with the only draw being the bicycle benefit facing elimination.

Equally significant was ACT’s role in blocking the return of the Unrelated Business Income Tax (UBIT) on nonprofits. Originally included in the House version, this provision would have imposed a 21% tax on nonprofit spending related to commuter benefits. ACT joined forces with key allies to ensure it was stripped from the Senate version, and ultimately, from the final bill.

Commuter Tax Benefit Recommendations - White Paper

Beginning this work in 2024, ACT's Commuter Tax Benefits Work Group set out to create recommendations for enhancing and improving the current Qualified Transportation Fringe Benefit (QTFB). ACT's Board of Directors officially approved the group's recommendations, and we are excited to share our work with the broader membership. This white paper includes the history of the QTFB, why protecting and improving these benefits is critical for TDM, and a detailed explanation of our recommendations.

Please contact Government Affairs and Policy Manager Emma Wasserman with any comments or questions.